Table of Contents

Property prices in Gurgaon don’t move randomly.

They respond.

They adjust.

They react to forces most buyers don’t fully notice until it’s too late.

By 2026, Gurgaon’s real estate market is no longer driven by hype alone. Buyers are more cautious, lenders are stricter, and developers are pricing with sharper intent. Anyone trying to understand what influences property prices today needs to look beyond location buzzwords and glossy brochures.

This blog breaks down the real factors influencing property prices in Gurgaon in 2026—from interest rates and infrastructure to buyer psychology and financing realities—so you can read the market with clarity, not confusion.

Why Understanding Price Influencers Matters More in 2026

A decade ago, buyers asked:

“Will prices go up?”

Today, smarter buyers ask:

“Why are prices moving—and will that reason still matter in five years?”

The difference between speculation and informed buying lies here.

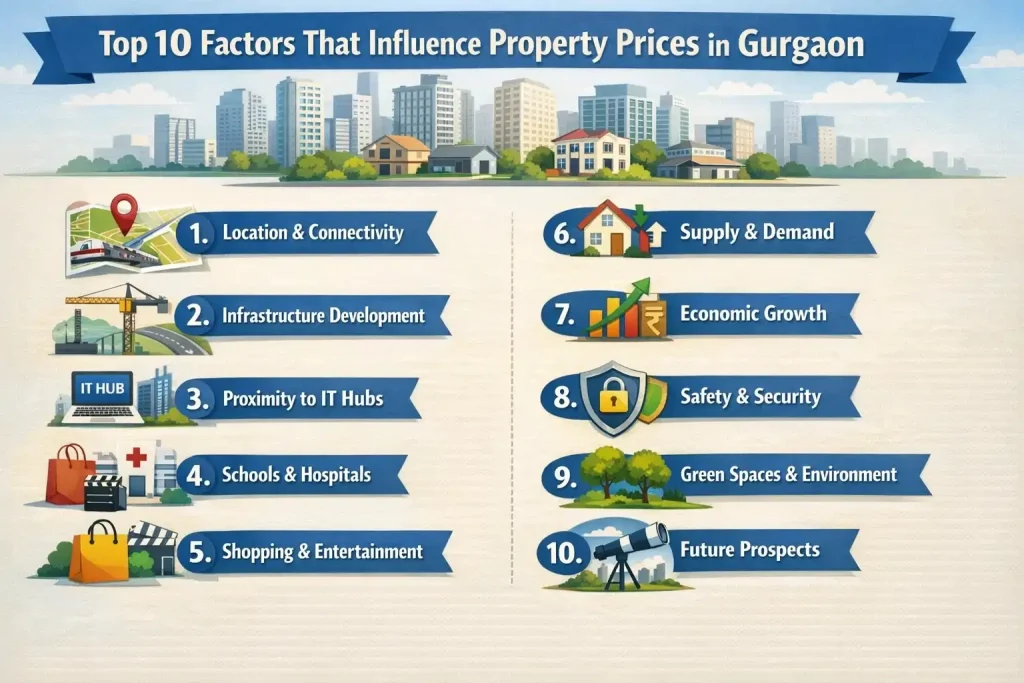

Let’s walk through the ten most important forces shaping Gurgaon property prices in 2026.

1. Interest Rates and Borrowing Costs

Property prices don’t rise in isolation.

They rise with money availability.

Current building loan rates directly affect:

- affordability

- EMI comfort

- buyer demand

When interest rates rise, purchasing power falls—even if property prices don’t immediately drop. This creates:

- slower sales

- longer negotiations

- selective discounts

Interestingly, global conversations around mobile home mortgage interest rates often highlight the same truth: housing markets cool when borrowing becomes expensive, regardless of property type.

In Gurgaon, interest rate sensitivity is now stronger than ever because a large portion of buyers rely on loans.

2. Buyer Affordability and the New Homeowner Mindset

“How to become a homeowner” looks very different in 2026 than it did five years ago.

Buyers today are:

- EMI-conscious

- long-term focused

- wary of overleveraging

This shift influences pricing.

Developers can no longer price purely on aspiration. They must factor in:

- monthly affordability

- loan eligibility

- buyer risk tolerance

As a result, properties that fit realistic budgets see better price stability than ultra-premium speculative inventory.

3. Location Isn’t Enough—Micro-Location Is

Location still matters.

But micro-location matters more.

In Gurgaon, two projects in the same sector can have very different price trajectories based on:

- access roads

- traffic bottlenecks

- proximity to offices

- livability, not just connectivity

This is why blanket statements about “Sector X appreciation” often fail. Buyers now price homes based on daily experience, not map distance.

Humne pehle bhi “Buying Property in Gurgaon Better Than Renting? A 10-Year Financial Comparison“ par detail me discuss kiya hai…

4. Infrastructure: Utility Over Announcement

Infrastructure influences property prices—but only when it becomes usable.

By 2026, buyers have grown skeptical of:

- long-pending announcements

- delayed corridors

- future promises

Infrastructure adds value when it:

- reduces commute time

- improves daily mobility

- supports employment access

Markets have matured enough to distinguish between announcement-driven spikes and real, sustainable appreciation.

5. Supply vs Demand Imbalance

One of the biggest factors influencing property prices in Gurgaon is supply concentration.

In areas where:

- too many similar projects exist

- investor inventory dominates

- occupancy remains low

Prices struggle to rise meaningfully.

Conversely, pockets with:

- limited fresh supply

- strong end-user demand

- consistent absorption

see healthier price movement.

Oversupply no longer hides behind marketing.

6. Construction Quality and Project Credibility

Buyers in 2026 don’t assume quality.

They verify it.

Construction quality affects:

- resale value

- rental demand

- long-term maintenance costs

Projects with:

- visible defects

- delayed timelines

- inconsistent execution

face price resistance—even in prime locations.

This is why brand credibility now influences pricing more than advertising spend.

7. Financing Trends and Loan Accessibility

Loan accessibility has become a silent price driver.

Even if buyers are interested, prices soften when:

- banks tighten eligibility

- valuations fall below asking prices

- approvals slow down

In contrast, projects that are:

- lender-friendly

- clearly documented

- RERA-compliant

enjoy smoother transactions and stronger price confidence.

This is where concepts like mobile home value calculator—used in other housing markets—reflect a broader truth: when financing tools tighten valuations, prices adjust accordingly.

8. Buyer Preferences and Lifestyle Shifts

Property prices reflect what people want to live in—not just what’s built.

By 2026, buyer preferences have shifted toward:

- functional layouts

- work-from-home flexibility

- manageable maintenance

- practical amenities

“New home ideas” today focus less on size and more on usability.

Projects that align with these lifestyle changes hold value better than oversized, impractical homes.

9. Rental Demand and Yield Reality

Rental demand doesn’t just affect investors.

It affects prices.

Areas with:

- stable tenant demand

- proximity to job hubs

- livable infrastructure

support stronger valuations.

Where rental yields collapse or vacancies rise, resale prices eventually feel the pressure.

Buyers now look at rent not as income alone—but as proof of demand.

10. Market Sentiment and Buyer Psychology

Finally, the most unpredictable factor:

sentiment.

Fear slows markets.

Confidence accelerates them.

But unlike earlier cycles, sentiment in 2026 is shaped by:

- lived experience

- peer stories

- resale outcomes

- delivery track records

Emotional buying still exists—but it’s more cautious.

And cautious buyers cap irrational pricing.

How These Factors Work Together

No single factor decides price.

Property prices move when:

- affordability meets confidence

- infrastructure meets usability

- supply meets real demand

Miss one link, and appreciation slows.

This interconnectedness defines Gurgaon’s 2026 market.

What Buyers Should Focus On in 2026

Instead of asking:

“Will prices rise here?”

Ask:

- Who is buying here—and why?

- Can people afford this long-term?

- Does rental demand exist?

- Will this home still make sense if interest rates rise?

These questions protect buyers better than predictions.

Final Reality Check

Property prices in Gurgaon are no longer driven by hope alone.

They are shaped by:

- financial reality

- buyer maturity

- execution quality

- lived utility

Those who understand the factors that influence property prices don’t chase markets.

They enter them with timing, clarity, and patience.

FAQs

1. What is the biggest factor influencing property prices in Gurgaon in 2026?

Affordability combined with interest rates and real demand.

2. Do interest rates really affect property prices?

Yes. Higher rates reduce buyer capacity and slow price growth.

3. Is infrastructure still a strong price driver?

Only when it becomes usable—not just announced.

4. Do buyer preferences matter now?

More than ever. Lifestyle fit influences long-term value.